Rubi Rose’s Financial Success Story – How DDG Inspired Her OnlyFans Journey

Rubi Rose’s Financial Success Story – How DDG Inspired Her OnlyFans Journey

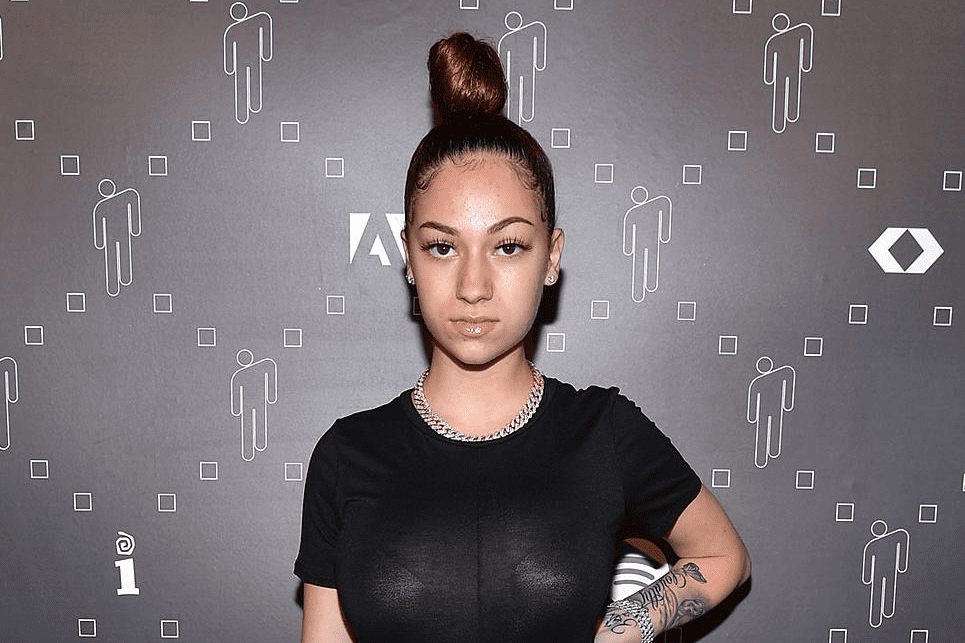

Rubi Rose, the rising hip-hop star, recently spilled the tea on her booming OnlyFans venture during a chat on Logan Paul’s IMPAULSIVE podcast. Surprisingly, it was her ex-boyfriend DDG who nudged her into the lucrative world of OnlyFans, catapulting her life to new heights.

Rubi Rose’s Financial Success Story – How DDG Inspired Her OnlyFans Journey

“I don’t want to be known as an OnlyFans sex worker, please guys… That’s what makes the most money, my OnlyFans. I started OnlyFans in 2020 during the pandemic,” Rose disclosed in the interview. “My ex did it, DDG. He started it first and told me to do it.”

Already showcasing her moves on Instagram, Rose took the plunge, dropping out of college and relocating to LA. Since then, her life has been an upward trajectory, marked by property investments, houses, and cars for herself, friends, and family.

DDG has moved on, now with Halle Bailey and a new addition to the family, baby Halo. Despite the past, Rose harbors no resentment, extending warm wishes to the new family.

Join the conversation! Share your thoughts in the comments below, and stay tuned for more updates.

Rubi Rose’s Financial Success Story – How DDG Inspired Her OnlyFans Journey